Get the free income verification documentation form

Show details

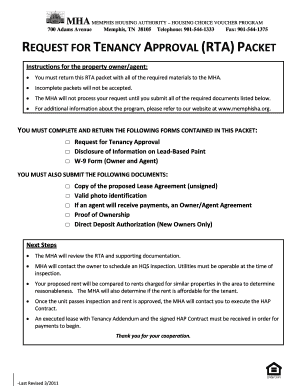

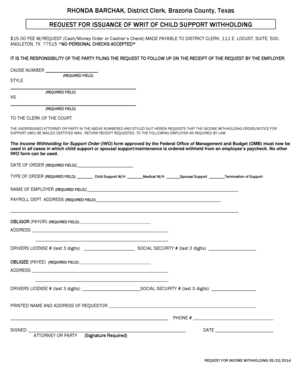

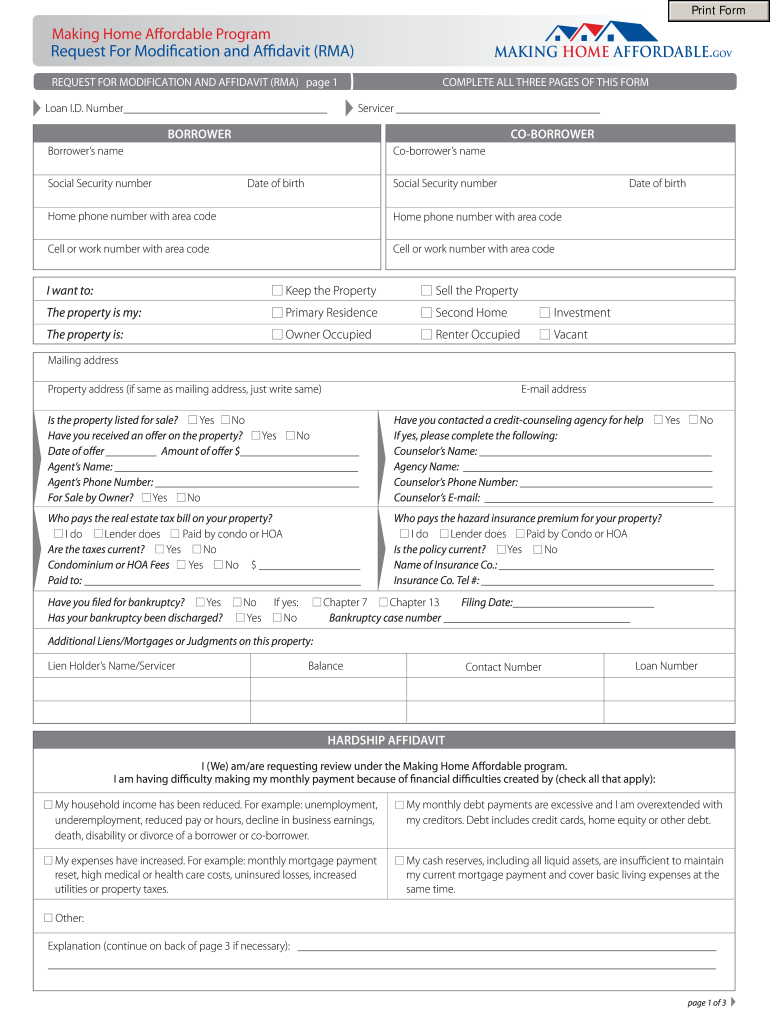

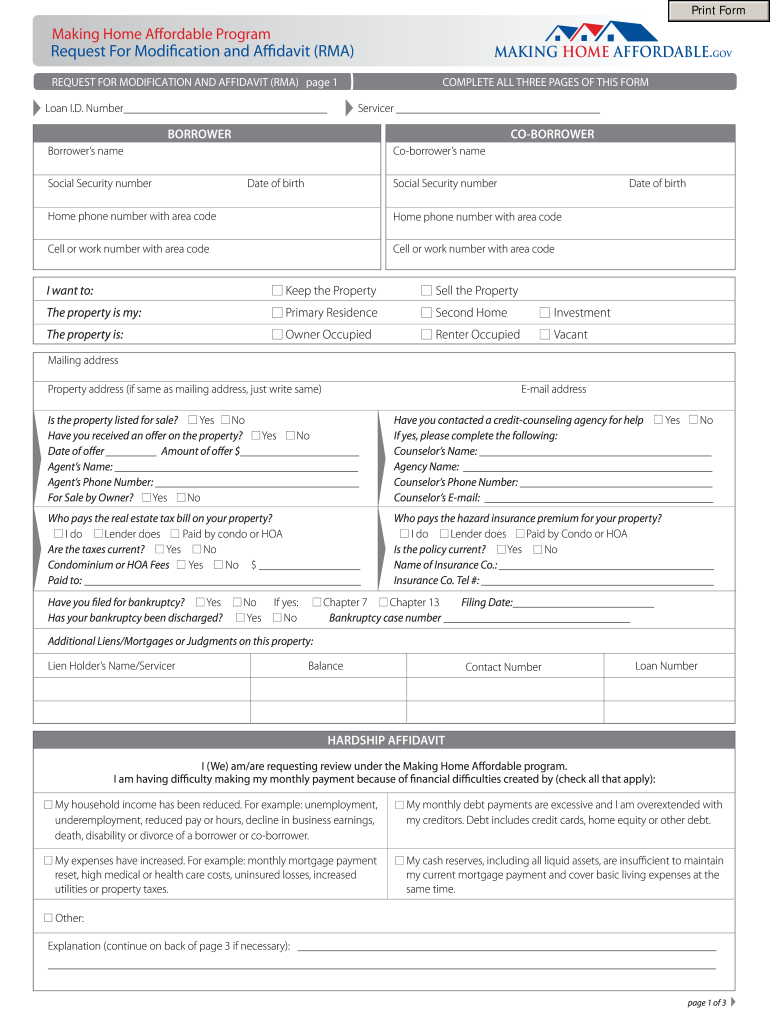

Print Print Form Form Making Home Affordable Program Request For Modification and Affidavit RMA REQUEST FOR MODIFICATION AND AFFIDAVIT RMA page 1 Loan I. D. Number COMPLETE ALL THREE PAGES OF THIS FORM Servicer BORROWER Borrower s name Social Security number Co-borrower s name Date of birth Home phone number with area code Cell or work number with area code I want to Keep the Property Sell the Property The property is my Primary Residence Second Home Investment Owner Occupied Vacant Mailing...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your income verification documentation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income verification documentation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income verification documentation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit request for modification and affidavit form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out income verification documentation form

How to fill out home affordable request modification:

01

Gather all necessary documents and information: Before starting the application, make sure you have all the required documents and information at hand. This may include proof of income, bank statements, tax returns, and a completed hardship affidavit.

02

Review and understand the eligibility criteria: Familiarize yourself with the eligibility requirements for the home affordable request modification program. These criteria may vary depending on the specific program and your lender.

03

Complete the application form: Fill out the application form accurately and provide all the requested information. Be thorough and include any supporting documentation required.

04

Write a hardship letter: Explain your financial hardship in a well-written hardship letter. Clearly state the reasons why you are requesting a modification and how it will help improve your ability to make monthly mortgage payments.

05

Submit the application: Once you have completed the application and accompanying documents, submit them to your lender. Follow the submission instructions provided by your lender and make sure to keep copies for your own records.

Who needs home affordable request modification:

01

Homeowners struggling to make their mortgage payments: The home affordable request modification is designed for homeowners who are facing financial hardships and find it difficult to meet their monthly mortgage obligations.

02

Individuals experiencing a decrease in income: If you have experienced a significant decrease in your income due to reasons such as job loss, reduced work hours, or medical issues, you may be eligible for a modification.

03

Borrowers with high-interest rates or adjustable-rate mortgages: Homeowners with high-interest rates or adjustable-rate mortgages may find it challenging to keep up with their payments. A modification can help reduce the interest rate or change the loan terms to make it more affordable.

Note: It is important to consult with your lender or a housing counselor to understand the specific requirements and options available for home affordable request modification in your situation.

Fill making home affordable modification form : Try Risk Free

People Also Ask about income verification documentation

How to negotiate loan modification?

What is a FHA loan modification?

What does loan modification mean for homeowners?

What happens in a loan modification process?

How does a hamp modification work?

What is hamp modification?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is home affordable request modification?

Home Affordable Request for Modification (HAMP) is a program initiated by the U.S. government as part of the Making Home Affordable (MHA) plan. It aims to help eligible homeowners who are struggling with mortgage payments to modify their existing home loan and make it more affordable.

Under HAMP, homeowners facing financial hardship may apply for a loan modification from their mortgage servicers. The modification is designed to lower monthly mortgage payments through various means, such as reducing the interest rate, extending the loan term, or even forgiving a portion of the principal balance.

To qualify for HAMP, homeowners need to meet certain eligibility criteria, including:

1. Owning a one-to-four-unit residential property.

2. Obtaining the mortgage on or before January 1, 2009.

3. Having a mortgage balance not exceeding the loan limit for their area.

4. Demonstrating financial hardship, such as unemployment, reduced income, or increased expenses.

5. Providing evidence of ability to make modified mortgage payments.

The goal of HAMP is to prevent foreclosure and stabilize the housing market by offering more affordable mortgage terms to struggling homeowners. The program provides a standardized framework for loan modification, with specific guidelines on how to determine eligible modifications and calculate sustainable monthly payments.

It is important for homeowners to contact their mortgage servicers or housing counselors to determine eligibility and initiate the Home Affordable Request for Modification process.

Who is required to file home affordable request modification?

Homeowners who are facing financial hardship and are unable to afford their mortgage payments may be required to file a Home Affordable Modification Program (HAMP) request. This applies to homeowners who have a mortgage owned or guaranteed by Fannie Mae or Freddie Mac, or those who have a mortgage serviced by a participating HAMP servicer. However, it is not mandatory for all homeowners, and eligibility criteria may vary depending on the specific circumstances and loan servicer. It is recommended to consult with a housing counselor or directly contact the loan servicer to determine eligibility and the necessary steps to file a request.

What is the purpose of home affordable request modification?

The purpose of the Home Affordable Request for Modification is to provide homeowners facing financial hardships an opportunity to modify their mortgage loans and make them more affordable. The program, started in response to the housing crisis of 2008, aims to help struggling homeowners avoid foreclosure and stay in their homes. By applying for a modification, borrowers can potentially lower their monthly mortgage payments, reduce interest rates, extend the loan term, or change other loan terms to better suit their financial situation.

How to fill out home affordable request modification?

To successfully fill out a Home Affordable Modification Program (HAMP) request, follow these steps:

1. Obtain the necessary form: Visit the official website of your loan servicer or the U.S. Department of Housing and Urban Development (HUD) website to download the HAMP request form. Alternatively, contact your loan servicer directly to request the form.

2. Review the eligibility criteria: Familiarize yourself with the eligibility requirements for HAMP. Typically, you must have a mortgage originated on or before January 1, 2009, your property must be your primary residence, your unpaid principal balance must be within specific limits, and you should be facing financial hardship.

3. Complete the borrower information section: Provide your personal details such as name, address, contact information, and Social Security number. Ensure accuracy to prevent delays or rejection.

4. State your loan information: Include your loan number, current mortgage lender, and the current outstanding balance. Indicate your payment status and the date you last made a payment.

5. Explain your financial hardship: Describe the circumstances that led to your financial hardship, such as job loss, reduced income, medical expenses, or other significant events impacting your ability to make mortgage payments. Be detailed and include supporting documents like layoff notices, medical bills, or pay stubs indicating reduced income.

6. Provide detailed financial information: Disclose your current monthly income, including all sources such as salary, rental income, alimony, etc. List your monthly expenses, including housing costs, utilities, insurance, debts, and other relevant expenses. Alternatively, you may need to attach supporting documents such as pay stubs, bank statements, or tax returns to verify your financial situation.

7. Indicate desired modification terms: State your preferred modification terms, including the desired interest rate, loan term, and any other specific changes you want to be considered. Be reasonable and keep in mind that the purpose is to make your mortgage more affordable.

8. Sign and date the form: Read through the completed form carefully and ensure all necessary sections are filled out accurately. Sign and date the form as required.

9. Gather supporting documents: Compile supporting documents requested by the loan servicer, such as income documentation, bank statements, or tax returns. These may vary based on the loan servicer's specific requirements.

10. Submit the application: Mail or electronically submit the complete HAMP request form and the accompanying documentation to your loan servicer as instructed on the form. Make a copy for your records.

Remember to follow up with your loan servicer to confirm they have received your application and to check on its status.

What information must be reported on home affordable request modification?

When submitting a Home Affordable Modification Program (HAMP) request, the following information generally must be reported:

1. Borrower Information: This includes the borrower's name, address, contact details, Social Security number, and other identifying information.

2. Loan Information: Details about the mortgage loan, such as the loan number, original loan amount, current outstanding balance, interest rate, and monthly payment amount.

3. Hardship Explanation: A written explanation of the financial hardship that makes it difficult for the borrower to afford the current mortgage payments. This should outline the specific reasons for the hardship, such as unemployment, reduction in income, medical expenses, divorce, etc.

4. Financial Documentation: Supporting documents that demonstrate the borrower's current financial situation, such as pay stubs, bank statements, tax returns, income verification, and expense details. These documents help the lender assess the borrower's ability to make modified mortgage payments.

5. Affidavit of Hardship: A legally binding statement signed by the borrower, declaring that the information provided is true and accurate, and acknowledging potential legal consequences for providing false information.

6. Proposed Modified Payment: A proposed new payment amount that the borrower can afford, along with an explanation of how the borrower arrived at this figure.

7. Other Documentation: Depending on the specific situation, additional documents may be required, such as proof of Social Security or disability income, alimony or child support documentation, current lease agreements (if applicable), etc.

It is important to note that while the above information provides a general overview, specific requirements may vary depending on the mortgage servicer or loan modification program being applied for. It is always advisable to consult the relevant program guidelines or contact the loan servicer for detailed instructions.

Can I create an electronic signature for signing my income verification documentation in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your request for modification and affidavit form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the home modification form form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign modification request and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit modification affidavit on an Android device?

With the pdfFiller Android app, you can edit, sign, and share mha rma form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your income verification documentation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Modification Form is not the form you're looking for?Search for another form here.

Keywords relevant to request modification form

Related to rma request modification

If you believe that this page should be taken down, please follow our DMCA take down process

here

.